By

Reuters

Reuters

Published

Jan 13, 2010

Jan 13, 2010

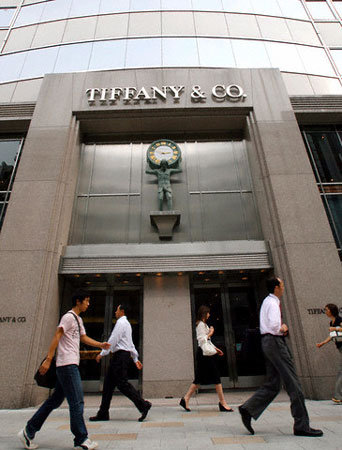

Tiffany, Signet holiday sales grow as splurges return

By

Reuters

Reuters

Published

Jan 13, 2010

Jan 13, 2010

CHICAGO (Reuters) - Tiffany & Co and Signet Jewelers Ltd saw holiday sales rise as shoppers began splurging on luxury items again and both jewelers said their profits should top expectations.

|

High-end retailers had felt the brunt of the recession, as shoppers avoided flashy and expensive purchases, such as jewelry, and focused on buying necessities.

During November and December 2008, Tiffany saw sales at its U.S. stores open at least a year plunge 35 percent in the wake of a global financial crisis that reined in even its most well-to-do customers.

During the same months of 2009, U.S. same-store sales rose 12 percent, with a 16 percent rise in November and a 10 percent rise in December.

The company's total same-store sales rose 8 percent on a constant exchange rate basis. The company's flagship store at Fifth Ave in New York saw sales jump 20 percent.

Tiffany's growth can be attributed to easy comparisons, innovative design as seen in its collection of key-shaped pendants and market share gains in a consolidating industry, Jefferies analyst Randal Konik said in a research note.

"We expect these tailwinds to continue into 2010," wrote Konik, who upgraded Tiffany to "buy" on January 4.

Standard & Poor's Equity Research analyst Marie Driscoll raised her recommendation on Tiffany shares to "buy" from "hold" on Tuesday 12 January and increased her price target by $10 to

$55.

"Today more than ever, there is an appreciation of those brands that represent genuine, lasting value," Chief Executive Michael Kowalski said in a statement. "This greatly benefits Tiffany."

Tiffany shares dipped 1.5 percent on Tuesday 12 January, coming off a year high of $47.01 hit on Monday 11 January. Signet, whose shares are up nearly fivefold since hitting a low in February, slipped 2.6 percent.

A RISING TIDE, FEWER BOATS

Overall U.S. jewelry sales rose 6.9 percent in December, their fourth consecutive month of growth, according to data released by SpendingPulse last week. Within jewelry, mid-tier mall-based chains suffered, while lower and higher-end retailers remained strong, SpendingPulse said.

Tiffany and Signet also face less competition as spending trends turn higher, with chains from Fortunoff to Finlay Enterprises having gone bankrupt in the last year.

Signet, which runs the Kay Jewelers and Jared The Galleria of Jewelry chains in the United States, said same-store sales rose 5.6 percent in the nine weeks that ended on January 2, including a 7.6 percent increase in the United States.

Same-store sales in Britain, where it runs H Samuel and Ernest Jones, fell 0.8 percent.

Tiffany said its net worldwide sales rose 17 percent to $799.1 million during November and December, with a 15 percent rise in the Americas region, an 11 percent increase in Asia-Pacific and a 30 percent jump in Europe.

For the fiscal year ending on January 31, Tiffany now expects to earn $2.07 to $2.12 per share from continuing operations, up from its earlier view of $1.88 to $1.98 per share. It is on track to achieve net sales of about $2.7 billion for the year.

Analysts, on average, had anticipated Tiffany would earn $1.92 per share on revenue of $2.65 billion, according to Thomson Reuters I/B/E/S.

Signet, which runs 1,933 stores, forecast earnings per share of $1.76 to $1.84 for the year ending January 30, compared with analysts' average forecast of $1.64. Full-year net debt would be below $50 million, it added.

(Reporting by Jessica Wohl in Chicago, Nivedita Bhattacharjee in Bangalore and Mark Potter in London; Editing by Michele Gershberg, Dave Zimmerman)

© Thomson Reuters 2024 All rights reserved.