May 15, 2019

Luxury industry facing reduced profitability, says Bernstein study

May 15, 2019

"There are three forces acting on today's luxury market: digital expansion, new consumers and growing competition for the best locations. These three factors have a strong impact on costs, directly affecting returns on invested capital, which have therefore reduced significantly," explains Bernstein analyst Luca Solca, summarising the findings of the Altagamma Retail Revolution study carried out on the state of luxury retail for the Italian luxury brand association.

Digital retail has revolutionised the luxury market, pushing brands to rethink their growth strategies. But now more than ever the phenomenon of e-commerce is shaping the industry, radically changing its power dynamics.

First of all, the internet has lowered the hurdles barring access to the market, allowing new brands, in particular accessory labels offering products such as footwear, watches and eyewear, to try their luck in the big leagues without incurring prohibitive costs. South Korean eyewear label Gentle Monster, for example, is a testament to this new accessibility, having skyrocketed to the status of a global brand in a relatively short period of time.

"Digital also brings the shortcomings of physical stores into focus, highlighting large discrepancies in price, for example, with discounts of over 30% to be found on new products sold online. The credibility of luxury houses has therefore taken something of a blow," pointed out Solca, encouraging brands to "have a clean-out of their wholesale distribution."

Furthermore, algorithms now allow companies to analyse what's happening in the market in real time, a fact which means that large groups such as WeChat, Amazon, Google, Alibaba and Instagram can adapt very rapidly and are therefore positioning themselves as important new distributors in the luxury industry.

It's with these factors in mind that brands should be approaching the luxury sector's new customers, namely Chinese consumers and millennials, who, as highlighted by Solca, "want new products, different to those purchased by their parents, and search for them almost exclusively via their smartphones or social networks." In order to attract their attention, brands should therefore "take risks in their stores," a strategy which implies "increasing levels of complexity and extra costs."

The battle has therefore moved into brick-and-mortar stores, which are increasingly expensive, especially considering the growing competition for retail locations. Given that big-name brands are already established at the most prestigious addresses, the study shows that between 2013 and 2018, 80% of the luxury boutiques inaugurated around the world were opened by brands that have positioned themselves in the accessible luxury segment, such as SMCP, Coach, Michael Kors and Tory Burch, among others.

"Competition has grown because there is less available space and there are only a few cities in the world where a brand absolutely has to have a retail presence, around 25, which is why costs are enormous. If you add to that the costs associated with the reduction of the wholesale network, expenses involved in staffing the stores, rising investments in marketing and the construction of an integrated sales system that's both e-commerce and omnichannel ready, the pressure on invested capital is huge," explains Solca.

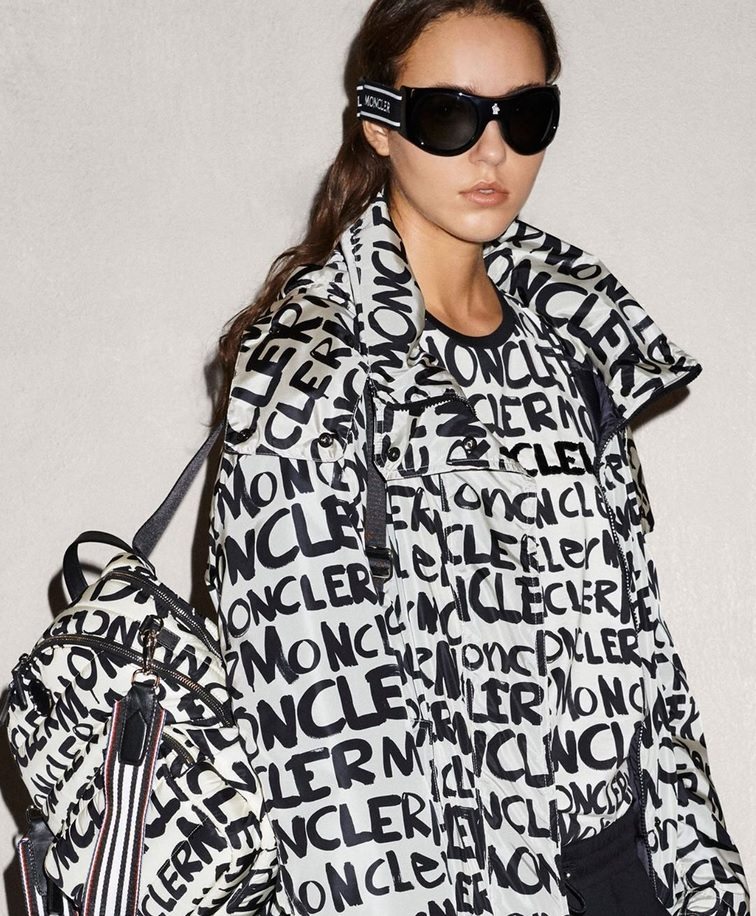

According to his study, even big-name brands that are able to compensate for these extra costs with strong revenues have seen the profitability of their investments plummet in the space of five years. At Prada, Salvatore Ferragamo and Tod's, in particular, the return on investment ratio reduced by a third in 2018 compared to 2013, a fact which has of course led to shares in the companies falling on the stock markets. At Moncler, on the other hand, return on investment doubled in the same period.

"Faced with an explosion of costs and complexity [...], it's clear that the scaling effect helps. Above all, it allows brands to up the productivity of their spaces. We've therefore seen something of a correlation between scale, total sales and operating margin," continued Solca.

For the analyst, the effect on operating profit is explained to around 75% by sales per square metre, as "luxury is above all a retail industry". In the future, however, a different question could become a determining factor if the increasingly vocal calls for transparency in the sector continue to grow: the question of whether or not brands manage the production and sourcing of their products directly. "In the future, upstream integration is going to be an important trend, and it's a challenge that luxury business should be increasingly concerned about," Solca concluded.

Copyright © 2024 FashionNetwork.com All rights reserved.