Reuters

Feb 3, 2011

Mid-caps early focus of European M&A cycle

Reuters

Feb 3, 2011

BRUSSELS, Feb 2 (Reuters) - Cash rich companies will go shopping for mid-cap firms in Europe this year as the early part of an M&A cycle takes hold, the co-head of European equities at Edmond de Rothschild Asset Management said on Wednesday.

|

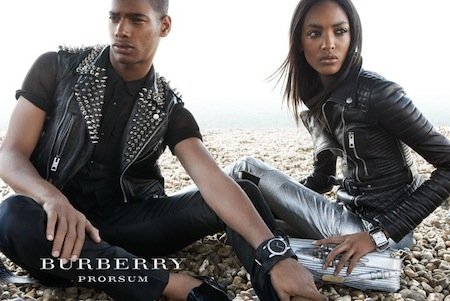

He picked out companies like BG Group (BG.L) and Burberry (BRBY.L) in Britain, and Italy's Bulgari (BULG.MI) as likely targets.

"Currently we look more at the mid caps at this stage of the M&A cycle, it's really the core of the M&A activity," Philippe Lecoq told the MoneyTalk Morningstar Fund Summit 2011.

"During the first part of the M&A cycle companies are still spending their cash very cautiously and they are all communicating about bolt-on acquisitions so they are making M&A again but very cautiously."

Later bigger companies would start taking more risks with their cash and do bigger deals, which could indicate that the M&A cycle was coming to an end, he said.

Lecoq said that the M&A cycle started in June last year and was likely to continue through 2011.

He picked out chemicals, IT and luxury goods as sectors that could see consolidation.

"There are some common points between those sectors ... the leaders are very cash rich," he said.

In IT he forecast that Microsoft (MSFT.O) or HP (HPQ.N) could make an acquisition in Europe.

In the chemicals sector companies like Dow Chemicals (DOW.N) or Germany's BASF (BASFn.DE) could buy up a speciality chemical company like Umicore (UMI.BR) or British firms Croda (CRDA.L) and Johnson Matthey (JMAT.L).

"That kind of asset will give them less sensitivity to the economic cycle, more pricing power and more exposure to the emerging growth," he said.

In the luxury market companies like LVMH (LVMH.PA) or Swatch (UHR.VX) are looking to buy in prestigious brands.

"That's why we are convinced that Burberry and Bulgari are potential targets," he said.

He said other possible targets included British gas company Centrica (CNA.L), which could be purchased by Russia's Gazprom (GAZP.MM), British company BG Group (BG.L), which would be appealing to BHP Billiton (BLT.L) or Exxon Mobil (XOM.N) due to its reserves in Brazil. (Editing by David Cowell)

© Thomson Reuters 2024 All rights reserved.