Published

Aug 30, 2011

Aug 30, 2011

Newcomers drive growth in luxury market

Published

Aug 30, 2011

Aug 30, 2011

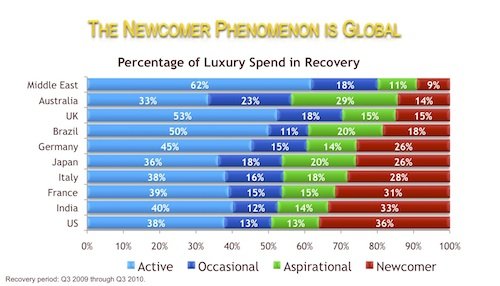

The success of the luxury sector cannot be questioned. And according to American Express Business Insights, the reason behind it is the arrival of a new group of luxury consumers, referred to as the newcomers, who are not particularly rich but who are spending a lot in high-end fashion and restaurants. American Express’ consulting organisation ‘Business Insights’ carries out several sectoral studies which often go unpublished, so FashionMag.com brings you an exclusive report on the highlights of this study which collected its data from 90 million American express card holders in over 125 countries.

Bottega Veneta A/W 2011-12 collection(photo by Pixel Formula) |

First of all, it is important to note that luxury spending took a dive in 2009 in all regions analysed in the study: -17% in Australia, Japan and Brazil; -12% in the United States and -15% in Europe. In 2010, only the European market was still in negative at -2%. In Japan and Australia, the luxury sector started to climb again to a positive 7%. The same happened in other countries, with Brazil and India showing +12% and the United States +9%. Then, in the first quarter of 2011, the rate of spending accelerated. In Australia and Japan it jumped to 47%, in India and Brazil 34%, in the United States 10% and even in Europe it went up to 17%.

|

This is the period when the newcomers began to emerge: a new group of luxury consumers who, according to American Express Business Insights, were not buying these types of products before the recession. The study shows that, in the third quarter of 2010, the newcomers’ share of luxury spending represented 36% of the total in the United States, thus being almost at the same level as regular consumers, who made up 38%.

India was the second country to have its luxury market dominated by the newcomers, whose spending rate consisted of 33% in the country. Newcomers in France came third at 31%, followed by Brazil at 18%, then the United Kingdom at 15% and Australia at 14%. The region where this new group of consumers had the least impact was in the Middle East, representing only 9% of luxury spending. There, the market is dominated by regular consumers, who represented 62% of the total. As for Australia, occasional buyers were the major players.

American Express Business Insights suggests that consumers belonging to the Generation X are also reorienting luxury spending habits. They are searching for new holiday destinations, are more willing to try new brands than Baby boomers, and are more interested in gadgets and interior design. The study also revealed that this group is made up of many more men in comparison to the other categories. In France, for example, 61% of the Generation X consisted of men, against 52% for the generation of Baby boomers.

Copyright © 2024 FashionNetwork.com All rights reserved.