Reuters

Feb 2, 2011

Head of Gap brand out, outlet exec in line

Reuters

Feb 2, 2011

|

Earlier on Tuesday, Gap announced that Marka Hansen, who led the Gap brand in North America since 2007, was stepping down and her successor would be named within a day.

Multiple sources inside and outside of the company, who asked not be named, cited Art Peck as the likely candidate to replace Hansen.

A source familiar with the matter confirmed to Reuters that Peck would be named.

Peck, who is also executive vice president of strategy and operations for the company, is in the unique position of working at both the corporate and divisional levels.

Hired in 2005 from the Boston Consulting Group, Peck oversaw corporate strategy before being tapped three years later by Chief Executive Glenn Murphy to head the outlet unit, which operates stores under the Gap and Banana Republic brands.

In a bid to potentially raise Peck's profile on Wall Street, Murphy has cited Peck's efforts at the company in recent conference calls with analysts, calling outlets "a very successful part of the corporation."

The departure of Hansen was not unexpected on Wall Street, as Murphy has expressed frustration over the slow pace of a turnaround at that unit, which had its heyday in the 1980s and 1990s as the go-to retailer for casual American style.

Peck, who received an MBA from Harvard Business School, may have been viewed as a "relief pitcher" by Murphy, said Stifel Nicolaus analyst Richard Jaffe.

"Through his dual roles ... he's had a bird's eye view of the Gap division that makes him uniquely qualified to hit the ground running," said Jaffe.

Murphy's style as CEO is "deliberate and thinking a few innings out. This change with Marka was telegraphed at least three quarters ago."

ERRATIC SALES

Hansen -- a 24-year company veteran who held top roles at Gap, Banana Republic and in the International division -- was a merchandiser charged with attracting new design talent to bring the most appealing line of clothing into stores and simplifying operations.

But while Hansen succeeded in making the supply chain function more efficiently and naming the respected Patrick Robinson as head designer, her efforts did not bring about a lasting turnaround in sales.

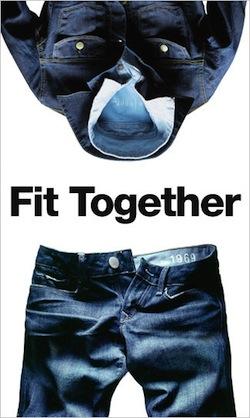

Despite the successful launch of jeans and black casual pants that sparked hopes the retailer was looking to its one-time signature look of classic, casual and comfortable style, the gains could not be sustained.

Most recently, Hansen's attempt to update Gap's iconic logo came under intense fire from customers who preferred the original blue box design.

The outcry in October forced Hansen to backtrack, and Gap scrapped the new logo just one week after launching it. Hansen acknowledged at the time that the company "did not go about this in the right way.

"GLORY DAYS"

Gap, which began in 1969 San Francisco as a seller of jeans, has struggled in the past decade with intense competition, a series of executives and mixed strategies to lure consumers -- all of which sent Gap's loyal customers scurrying to rivals.

Although Hansen's tenure helped stem that tide, the performance of stores has been inconsistent. Sales at Gap's namesake North American stores open at least a year, or same-store sales, fell 8 percent in December and were negative in five other months during 2010.

"The competitive environment is much more challenging than it was in Gap's glory days and it would be difficult for any merchant to fix," wrote Nomura analyst Paul Lejuez in a note.

Gap, which also operates the Old Navy and Banana Republic chains, also said on Tuesday it was "comfortable" with the current Wall Street profit view for its just-ended fiscal year.

Wall Street analysts on average are expecting a companywide profit of $1.82 per share for the year, according to Thomson Reuters I/B/E/S.

The retailer said it would comment on its outlook on Thursday, when it reports its January sales results. Analysts estimate companywide same-store sales fell 2.9 percent last month.

Gap shares closed up 25 cents to $19.52 on the New York Stock Exchange.

(Editing by Gerald E. McCormick, Lisa Von Ahn, Gunna Dickson, Bernard Orr and Andre Grenon)

© Thomson Reuters 2024 All rights reserved.