By

Reuters

Reuters

Published

Jul 13, 2010

Jul 13, 2010

Playboy bidding war looms

By

Reuters

Reuters

Published

Jul 13, 2010

Jul 13, 2010

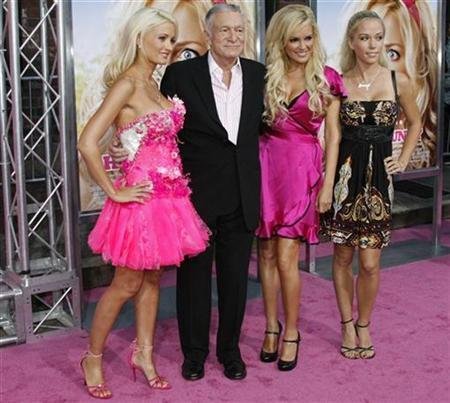

(Reuters) - Playboy Enterprises Inc (PLA.N) looks likely to be in play, with opposing bids from founder Hugh Hefner and the company that owns long-time rival Penthouse magazine. Shares of Playboy shot up 42 percent in New York Stock Exchange mid-day trade.

|

Hefner on Monday offered $5.50 in cash for each of the shares he doesn't already own, a premium of about 40 percent to the Friday closing price of the Class B shares. The bid values Playboy at $185 million.

Hefner currently owns around 70 percent of Playboy's Class A common stock and 28 percent of its Class B stock.

Shortly after the announcement, Friend Finder Network, the owner of Penthouse, said it was preparing to make a counteroffer later on Monday. Friend Finder Chief Executive Marc Bell said Hefner's offer "dramatically" undervalues Playboy.

The offers for Playboy come as the company struggles with a drop in advertising revenue and a decline in readership at its iconic flagship magazine.

In late June, the company said it cut staff to save $3 million annually.

More than a year ago Playboy appointed Scott Flanders, the former chief executive officer of Freedom Communications and the publisher of the Orange County Register, as its top executive. Previously, Christie Hefner, Hugh Hefner's daughter, ran the company.

Speculation mounted that Hugh Hefner was looking to exit the business he has controlled for more than 50 years as Playboy searched for a potential buyer.

In December, Playboy was in talks to sell itself to Iconix Brand Group Inc, a company that licenses clothing brands such as Joe Boxer, but no deal was reached.

Playboy has been trying to capitalize on its famous bunny ears logo by signing licensing deals with clothing makers, casinos and clubs as it moves away from its reliance on print advertising from its magazine.

Playboy said Hefner is partnering with Rizvi Traverse Management, which has said it will raise financing for the transaction from major lenders.

Hefner said in his proposal letter that he is not interested in any sale or merger of Playboy Enterprises, selling his shares to a third party or entering into discussions with any other financial sponsor for a similar transaction, according to the company.

(Reporting by Jennifer Saba and Yinka Adegoke; Editing by Gerald E. McCormick and Steve Orlofsky)

© Thomson Reuters 2024 All rights reserved.